Legal Insights Hub

Your go-to source for the latest in legal news and information.

Why Whole Life Insurance is Your Secret Wealth-Building Weapon

Unlock hidden wealth with whole life insurance! Discover how this powerful tool can boost your financial future today.

Unlocking the Power of Whole Life Insurance: A Comprehensive Guide

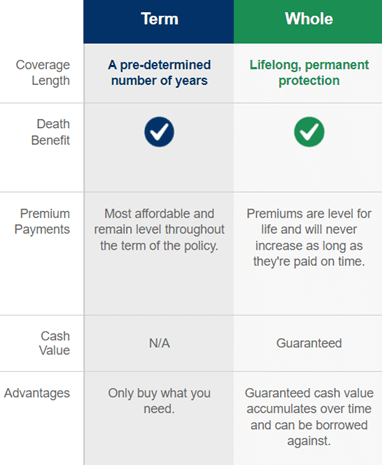

Whole life insurance is a powerful financial tool that provides lifelong coverage, combining protection with a savings component. Unlike term insurance, which lasts for a specified period, whole life policies offer a guarantee of payment to beneficiaries for the lifetime of the insured. This feature makes it an essential part of estate planning and financial security. By paying consistent premiums, policyholders not only ensure a death benefit for their loved ones but also accumulate cash value over time, which can be accessed if needed.

Unlocking the potential benefits of whole life insurance involves understanding its unique characteristics. Here are some key advantages:

- Lifelong Coverage: As long as premiums are paid, the coverage remains until death.

- Cash Value Accumulation: A portion of the premiums contributes to a cash value that grows over time, providing a financial resource for emergencies.

- Fixed Premiums: Premiums remain level throughout the life of the policy, offering predictability in financial planning.

Investing in whole life insurance can be a smart move for individuals seeking long-term financial stability.

Whole Life Insurance vs. Investment Accounts: Which is the Better Wealth-Building Strategy?

When considering Whole Life Insurance versus Investment Accounts, it's essential to understand the fundamental differences and benefits of each wealth-building strategy. Whole Life Insurance provides a death benefit along with a cash value component that grows over time, offering both protection and a potential growth avenue. In contrast, Investment Accounts allow for greater flexibility and potentially higher returns, as they can encompass a variety of assets, including stocks, bonds, and mutual funds. However, this comes with increased risk and volatility.

Ultimately, the decision between Whole Life Insurance and Investment Accounts as a wealth-building strategy depends on individual financial goals and risk tolerance. For those seeking stability and a guaranteed death benefit, Whole Life Insurance may be the better choice. However, for individuals aiming for higher returns and willing to navigate market fluctuations, focusing on Investment Accounts could yield significant wealth accumulation over time. Consider evaluating your long-term financial plans and consulting with a financial advisor to determine which path aligns best with your objectives.

Is Whole Life Insurance the Hidden Gem in Your Financial Portfolio?

When it comes to financial planning, many individuals overlook the potential value of Whole Life Insurance as a key component of their financial portfolio. Unlike term life insurance, which only provides coverage for a specific period, whole life insurance offers lifelong protection and, importantly, builds cash value over time. This cash value can be accessed through loans or withdrawals, serving as a financial resource for emergencies, retirement, or other investment opportunities. The stable growth of this cash value, often at a guaranteed rate, makes whole life insurance not just a safety net, but also a solid investment choice.

Moreover, whole life insurance comes with additional benefits that can further enhance its appeal. For instance, the life insurance proceeds are typically income tax-free for beneficiaries, allowing for a seamless transfer of wealth. Additionally, the policy’s dividends, which are not guaranteed but often paid by mutual companies, can be reinvested to purchase additional coverage or increase the cash value. As a result, whole life insurance can optimally serve not just as a protective measure but also as a strategic asset, potentially making it a true hidden gem in your financial portfolio.