Legal Insights Hub

Your go-to source for the latest in legal news and information.

Disability Insurance: Your Safety Net or a Bottomless Pit?

Is disability insurance your financial safety net or a costly trap? Discover the truth and make informed choices for your future!

Understanding Disability Insurance: Key Benefits and Considerations

Understanding disability insurance is crucial for anyone looking to safeguard their financial future against unexpected life events. This type of insurance provides income replacement if you become unable to work due to a disabling condition. The key benefits of disability insurance include financial stability during tough times, coverage for medical expenses, and peace of mind knowing that you can meet your living expenses even when you're unable to earn a paycheck. With options such as short-term and long-term disability policies, individuals can select the coverage that best suits their needs.

When considering disability insurance, it's important to evaluate various factors such as coverage limits, waiting periods, and premium costs. Key considerations include understanding the definition of disability in the policy, whether benefits are taxable, and how long you will receive them. Additionally, comparing different providers and their offerings can help you choose the right policy that aligns with your financial situation and lifestyle. Remember, having a strong safety net through disability insurance can be a vital part of your long-term financial planning.

Is Disability Insurance Worth the Cost? A Comprehensive Guide

When considering whether disability insurance is worth the cost, it's essential to evaluate both the risks associated with becoming disabled and the financial protection it offers. According to the Social Security Administration, approximately 1 in 4 of today’s 20-year-olds will become disabled before they retire. This statistic highlights the potential for unexpected circumstances that could significantly impact your ability to earn an income. Without proper coverage, you may face dire financial setbacks, increasing the importance of understanding how disability insurance can safeguard your financial future.

In addition to protecting your income, disability insurance can provide peace of mind. For many, the thought of losing their primary source of income can be overwhelming. Having a policy in place can alleviate some of this stress, allowing you to focus on your recovery rather than worrying about mounting bills. To assess its worth, consider these questions:

- What would your financial situation look like if you were unable to work for an extended period?

- Do you have enough savings to cover your expenses?

- How much income would you need to maintain your standard of living?

What to Look for in a Quality Disability Insurance Policy?

When searching for a quality disability insurance policy, it's crucial to evaluate the coverage options offered. Look for policies that provide comprehensive benefits, including total and partial disability coverage, as well as a range of waiting periods and benefit durations. Understanding the definitions of disability outlined in the policy is essential; some policies may only cover disabilities that prevent you from performing your job, while others offer broader definitions that encompass any work. This can significantly impact your financial security in the event of an unforeseen disability.

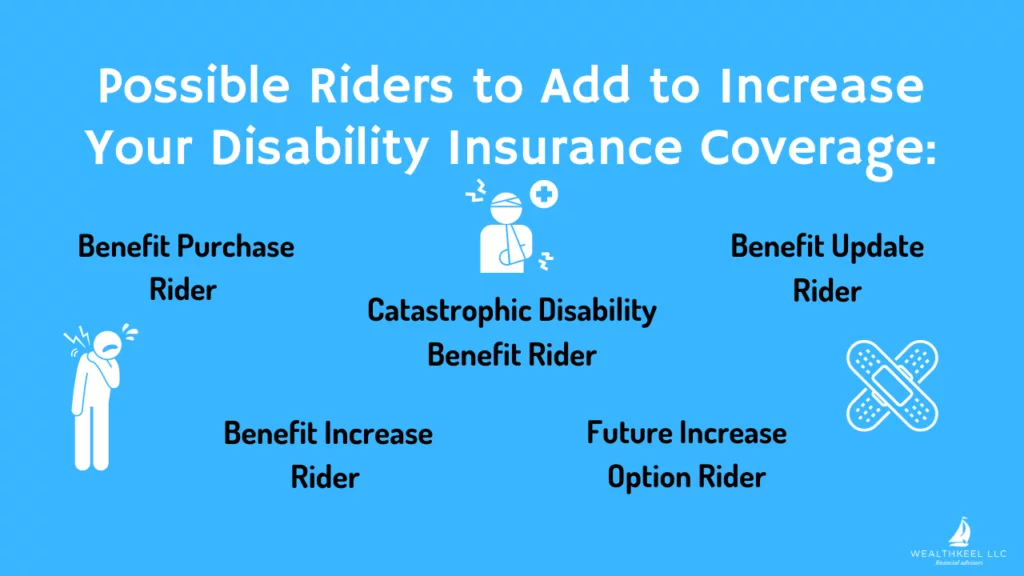

Another vital factor to consider is the premium costs relative to the benefits provided. Ensure that the policy fits within your budget while still meeting your needs. Additionally, check for guaranteed renewal options, which ensure you can keep your policy active regardless of changes in your health. It's also advisable to look for policies with an inflation rider, which adjusts the benefit amounts over time to maintain their purchasing power. By taking these elements into account, you can find a disability insurance policy that effectively safeguards your financial future.