Legal Insights Hub

Your go-to source for the latest in legal news and information.

Discounts That Drive You Crazy: How to Save Big on Auto Insurance

Unlock insane savings on auto insurance with our ultimate guide to discounts that could drive you wild! Save big today!

Maximizing Your Savings: Top 5 Discounts on Auto Insurance You Might Not Know About

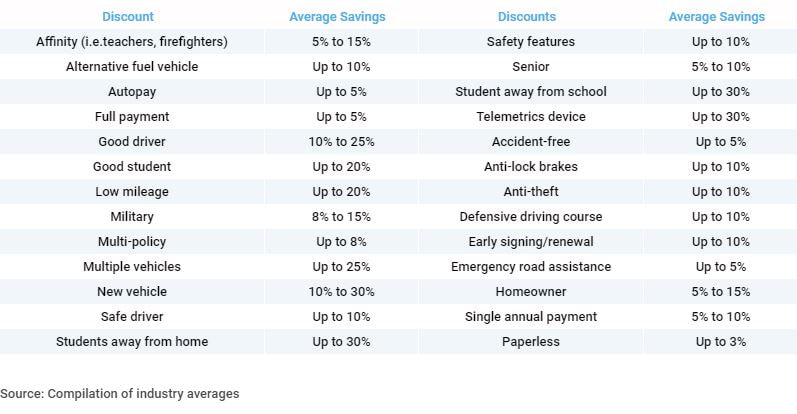

When it comes to maximizing your savings on auto insurance, many drivers overlook the potential discounts that can significantly lower their premiums. Discounts on auto insurance can vary widely among insurance providers, but here are five discounts you might not know about that could save you a substantial amount:

- Bundling Discounts: If you have multiple insurance policies (like home and auto), bundling them can lead to significant savings. Many insurers offer a discount for consolidating coverage.

- Safe Driver Discounts: Maintaining a clean driving record can earn you a discount. Insurers reward responsible drivers, so if you haven't had an accident in a few years, be sure to ask about this.

- Low Mileage Discounts: If you drive less than the average mileage per year, you might qualify for a low mileage discount. This is particularly relevant for those who work from home or have a second mode of transportation.

- Good Student Discounts: If you're a student with good grades, you may qualify for a discount on your auto insurance. It's worth inquiring about since many firms recognize academic achievement as a sign of responsible behavior.

- Defensive Driving Discounts: Completing a defensive driving course can not only make you a safer driver but also reduce your insurance premium. Many insurance companies offer this discount, recognizing your commitment to safe driving.

Exploring these discounts on auto insurance not only helps you save money but also ensures you have appropriate coverage at a reasonable price. To find the best deals, consider comparing rates from different insurance providers and asking about specific discounts that may apply to your situation. Websites like Insurance.com offer comprehensive resources for understanding various discounts available. Remember, maximizing your savings is just a question away, so don’t hesitate to reach out to your current insurer or shop around for the best rates!

Is Your Auto Insurance Premium Too High? Discover Hidden Discounts That Can Save You Big!

If you're feeling burdened by your auto insurance premium, you're not alone. Many drivers often find themselves questioning whether they are paying too much for coverage. The good news is that there are several hidden discounts that can lead to significant savings. For instance, did you know that many insurers provide discounts for safe driving records? Maintaining a clean driving history can help reduce your premiums over time. Additionally, bundling your auto insurance with other types of insurance, such as homeowner's or renter's insurance, can also lead to considerable savings.

Beyond safe driving and bundling, there are other discounts you might not be aware of. For example, military members, students with good grades, and members of certain organizations may qualify for additional discounts. It's worth asking your insurance agent about programs specific to your demographics and lifestyle. Furthermore, utilizing telematics programs—where insurers monitor your driving habits—can also reward you with lower rates, provided you drive safely. For a comprehensive guide on these discounts, check out Bankrate's resource on auto insurance discounts. By being proactive and exploring these options, you can ensure that you're not leaving money on the table.

The Ultimate Guide to Auto Insurance Discounts: How to Cut Costs Without Compromising Coverage

Finding ways to save on auto insurance can feel overwhelming, but discounts offer a straightforward path to reduce your premiums without sacrificing coverage. Some of the most common discounts include safe driver discounts, multi-policy discounts for bundling home and auto insurance, and good student discounts for younger drivers. For instance, you may be eligible for up to 20% off your premiums if you have a clean driving record.

In addition to standard discounts, many insurers offer unique incentives that vary by provider. For example, if you opt for usage-based insurance, you could save on your policy by demonstrating responsible driving habits. It’s essential to shop around and compare quotes from different companies to find the best deals. You can use resources like Insure.com to learn more about available discounts and calculate potential savings. By taking advantage of these opportunities, you can effectively manage your auto insurance costs while maintaining comprehensive coverage.