Legal Insights Hub

Your go-to source for the latest in legal news and information.

Insurance Showdown: Finding Your Perfect Match Without the Heartbreak

Discover the ultimate guide to choosing insurance that fits you perfectly—no heartbreak, just smart choices! Click to find your match today!

Top 5 Insurance Myths Debunked: What You Need to Know

When it comes to understanding insurance, myths can often lead to confusion and poor decision-making. Many people believe that insurance is always a waste of money, or that a low premium guarantees the best coverage. However, these beliefs can cost you dearly in the long run. In this article, we will explore the top 5 insurance myths that need debunking to help you make informed choices.

- Myth 1: All insurance policies are the same. This couldn’t be further from the truth. Each policy offers different coverage levels and exclusions, so it's crucial to read the fine print.

- Myth 2: You don’t need insurance if you're healthy. Accidents can happen anytime, and having insurance can provide peace of mind and financial security.

- Myth 3: Cheaper is better. While saving money is important, the cheapest policy may not provide the essential coverage you need.

- Myth 4: Claims are always denied. Many claims are approved, and knowing your policy can help ensure that yours is one of them.

- Myth 5: It's too late to get insurance. Regardless of age or health, there are always options available for insurance coverage.

How to Compare Insurance Policies: A Step-by-Step Guide

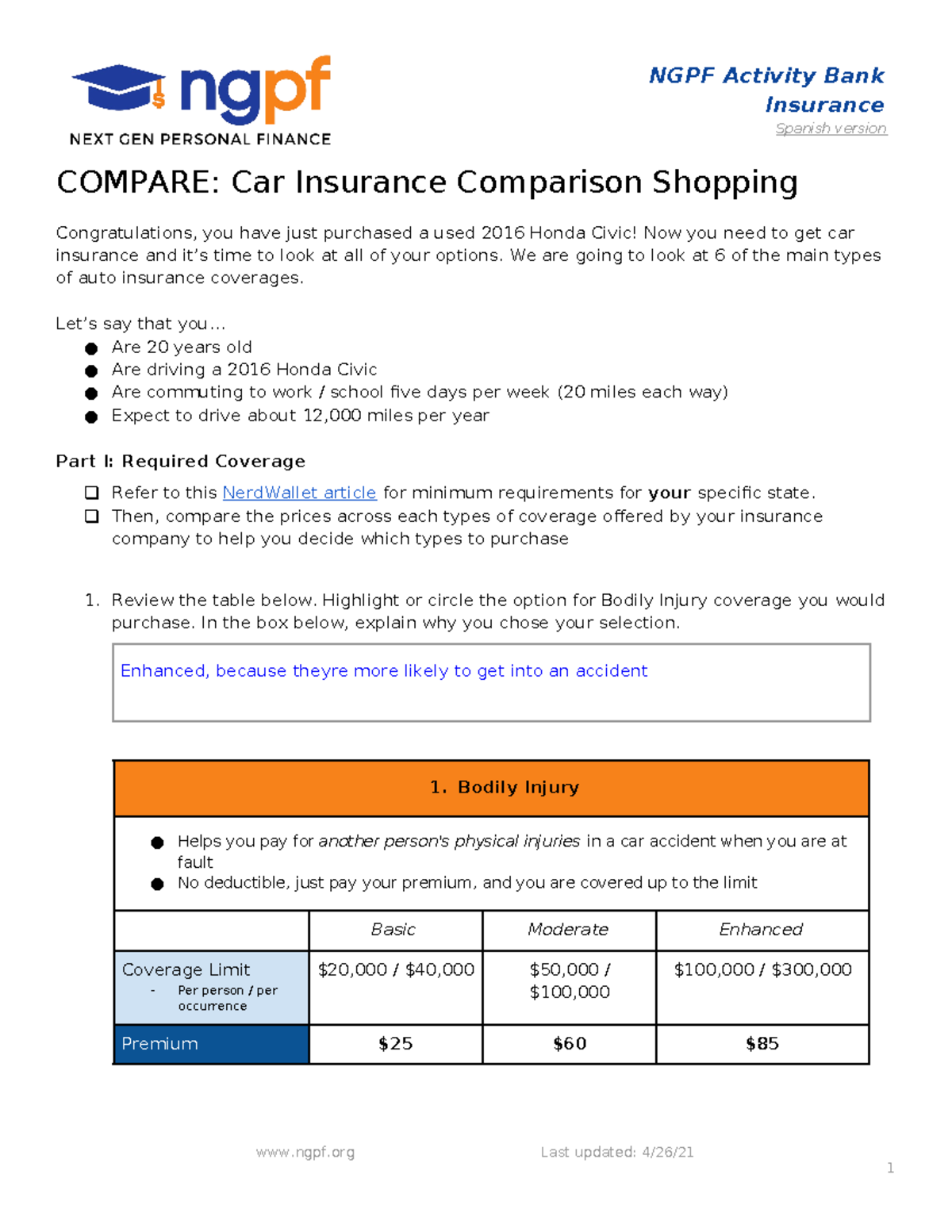

When it comes to comparing insurance policies, the first step is to identify your needs. Assess the type of coverage you require—whether it's health, auto, home, or life insurance. Make a list of essential features, such as deductibles, premiums, and coverage limits. This will serve as a benchmark against which you can measure different policies. Once you've established what you need, create a comparison chart to help visualize the differences between various options.

Next, review and compare quotes from multiple insurers. It's crucial to gather information from at least three different companies to ensure you're getting a comprehensive view of the market. During this phase, pay attention to policy exclusions and specific terms that may affect your coverage. Consider using an ordered list for easy reference:

- List the insurers.

- Write down the premiums.

- Note the coverage limits.

- Identify any exclusions.

By systematically comparing each aspect, you'll be better equipped to make informed decisions about which policy best suits your needs.

Is Your Insurance Coverage Love at First Sight or a Future Breakup?

When evaluating your insurance coverage, consider whether it feels like love at first sight or if it might lead to a future breakup. Many people rush into choosing insurance policies based solely on initial impressions, enticing premiums, or aggressive marketing. However, neglecting to read the fine print can lead to unpleasant surprises later on. Is your coverage sufficient for your needs? Always assess not just the initial appeal, but also how well the policy aligns with your long-term objectives and lifestyle changes.

As time passes, it’s essential to review your insurance coverage regularly to avoid the risk of a breakup. Just like relationships, insurance policies need constant attention and adjustment. Ask yourself if your current policy still suits your evolving needs. Create a checklist: Does it cover what you value most?, Are the premiums manageable?, and Is the provider responsive? If your answers lean towards dissatisfaction, it might be time for a reevaluation. Just remember, a healthy relationship with your insurance can protect you from unforeseen circumstances.