Legal Insights Hub

Your go-to source for the latest in legal news and information.

How to Score Big with Auto Insurance Discounts

Unlock huge savings! Discover insider tips on maximizing auto insurance discounts and keeping more cash in your pocket.

10 Common Auto Insurance Discounts You Might Be Missing

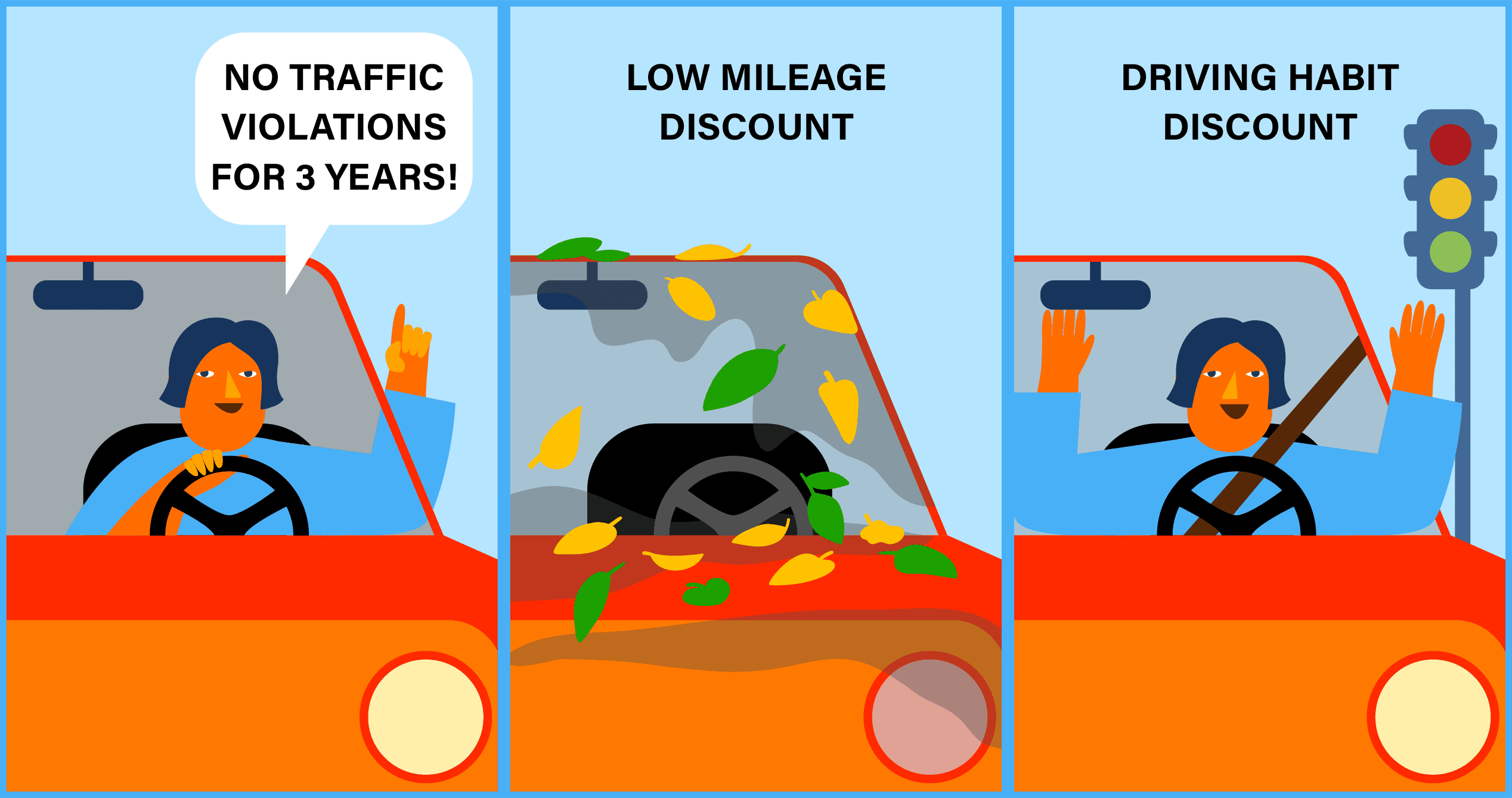

Auto insurance can be a substantial expense, but many drivers are unaware that they might qualify for various auto insurance discounts that can significantly lower their premiums. For instance, many providers offer discounts for safe driving records, where policyholders can receive a percentage off their rates for maintaining a clean driving history. Additionally, completing a defensive driving course can not only enhance your skills but can also make you eligible for yet another discount. It's essential to regularly review your policy and ask your insurer about any available discounts you might be missing.

Another common way to save on auto insurance is through bundled policies. If you have homeowners or renters insurance, consider combining your policies with the same company to leverage multi-policy discounts. Additionally, some providers offer discounts for low mileage, so if you primarily use your vehicle for short trips, you may be able to save more. For a complete list of potential discounts, check reputable sources like NAIC or Consumer Reports.

How to Qualify for the Best Auto Insurance Discounts

Qualifying for the best auto insurance discounts requires understanding the various criteria that insurers utilize to determine eligibility. Typically, discounts are offered based on factors such as your driving history, credit score, and the type of vehicle you drive. For instance, maintaining a clean driving record can qualify you for a safe driver discount. Additionally, many insurers provide reductions for bundling policies, such as combining home and auto insurance. It’s wise to shop around and compare quotes from multiple providers to identify the best deal available for your specific situation.

In addition to safe driving and bundling, consider taking advantage of discounts for low mileage or participation in defensive driving courses. Many companies offer a good student discount to young drivers that maintain a high GPA, reflecting responsible behavior. To maximize your savings, check with your insurer about other potential discounts, like those for having particular safety features in your car. Resources like the Consumer Reports provide insights on additional strategies to qualify for auto insurance discounts effectively.

Are You Taking Advantage of These Hidden Auto Insurance Savings?

In the quest for affordable auto insurance, many consumers overlook hidden auto insurance savings that can significantly reduce their premiums. One of the first steps in uncovering these savings is to regularly review your coverage and evaluate your needs. For instance, if you have an older vehicle, consider dropping collision or comprehensive coverage, which may not be worth the cost compared to the vehicle's actual cash value. Moreover, you can explore available discounts that insurers often provide. According to the Insurance Information Institute, discounts for bundling policies, maintaining a good driving record, or even being a good student can lead to substantial reductions in your premium.

Another effective strategy to discover hidden auto insurance savings is shopping around and comparing rates from different providers. Rates can vary widely, and sometimes the same coverage might come at a much lower price with a different insurer. Tools like ValuePenguin offer comparisons that can help you make informed decisions. Additionally, don't hesitate to negotiate with your current insurer; they might be willing to lower your premium to keep your business. Remember, a little diligence today can lead to significant savings tomorrow, so make sure to take full advantage of these strategies.