Legal Insights Hub

Your go-to source for the latest in legal news and information.

Why Whole Life Insurance Might Be the Secret Ingredient to Your Financial Pie

Unlock financial stability! Discover how whole life insurance could be the secret boost your financial plan needs for a secure future.

Understanding Whole Life Insurance: How It Can Complement Your Financial Plan

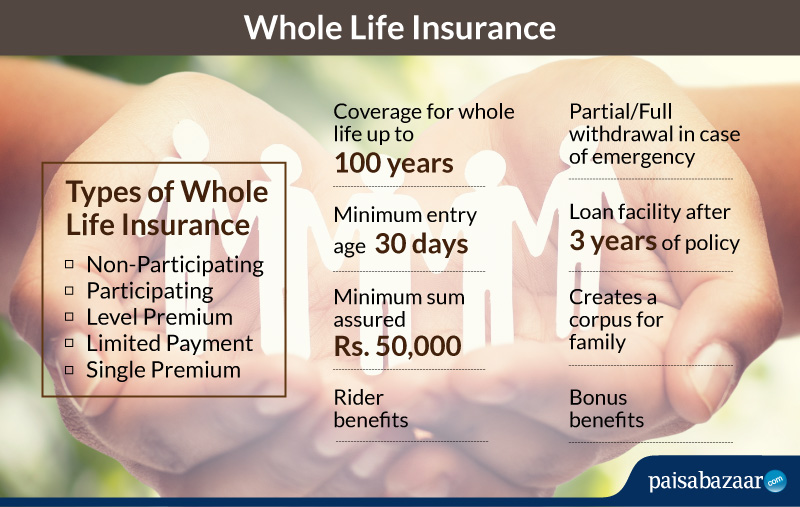

Whole life insurance is a type of permanent life insurance that not only provides a death benefit but also accumulates cash value over time. This dual function makes it a valuable asset in a comprehensive financial plan. Unlike term life insurance, which only covers you for a specified time, whole life insurance offers lifelong coverage, ensuring your loved ones are provided for no matter when you pass away. Additionally, the cash value component grows at a guaranteed rate, allowing you to leverage these funds for various financial needs such as education, retirement, or as an emergency fund.

Integrating whole life insurance into your financial strategy can offer several advantages. First, it serves as a stable investment option that can protect against market fluctuations. Furthermore, the accumulated cash value can be borrowed against, providing flexibility for major expenses while keeping your insurance policy active. It is essential to evaluate your long-term financial goals and consider how this type of insurance complements other elements of your portfolio, such as stocks, bonds, and mutual funds. Ultimately, a well-rounded approach that includes whole life insurance can enhance both your financial security and peace of mind.

5 Key Benefits of Whole Life Insurance You May Not Have Considered

When contemplating your financial future, whole life insurance can provide more than just a death benefit. One of the key benefits is that it accumulates cash value over time, which you can borrow against or even withdraw. This means that whole life insurance can serve as a savings vehicle, offering tax-deferred growth that can be tapped into in times of need.

Additionally, whole life insurance provides stability and predictability in your financial planning. With fixed premiums and guaranteed death benefits, you can rest assured knowing your loved ones will be financially protected regardless of market fluctuations. Moreover, this type of insurance often includes dividends, which can further enhance its value. Ultimately, considering these advantages can help you realize that whole life insurance is not just a safety net, but a powerful tool for wealth accumulation and financial security.

Is Whole Life Insurance the Missing Piece in Your Financial Strategy?

When considering a comprehensive financial strategy, many individuals overlook the potential benefits of whole life insurance. Unlike term life insurance, which provides coverage for a limited time, whole life insurance offers lifelong protection and builds cash value over time. This unique feature can serve as a financial safety net, enabling policyholders to access funds during emergencies or significant life events. By integrating whole life insurance into your financial plan, you not only secure peace of mind for your loved ones but also ensure a source of savings that can contribute to your overall wealth accumulation.

Moreover, whole life insurance can act as a valuable tool for tax diversification. The cash value component grows on a tax-deferred basis, allowing your investments to compound without immediate tax implications. This characteristic can provide significant advantages during your retirement years. As you evaluate your financial strategy, consider how whole life insurance fits into your long-term goals. Its blend of guaranteed protection and cash value growth can indeed be the missing piece that enhances your financial stability and prepares you for unforeseen challenges.